Compliance, Tax Tips

If you run your professional affairs through a company, trust, or partnership and more than 50% of your income comes from your personal skills or efforts, then you are earning Personal Services Income (PSI). This impacts the types of deductions you can claim, and the...

Compliance

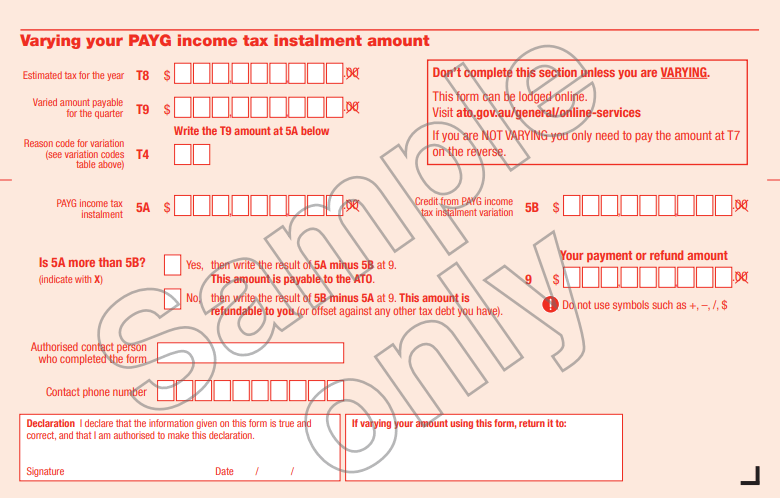

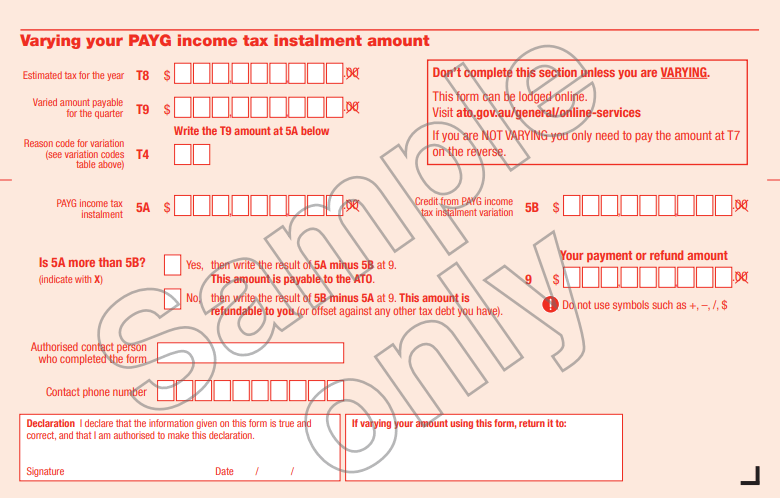

As the Tax Office continues to navigate the transition from paper, to digital, and back to paper communication, it appears that some clients are not receiving their PAYG instalment notices in the mail (or perhaps via email!) as expected. As such, if you haven’t...

Compliance

You might recall that earlier this year we shared an update about the new Director Identification Number regime. That regime is now in effect (from 1 November 2021). Existing and new company directors will now be required to apply and maintain their own personal...

Compliance

If you’re an existing client of ours, you’d know that we’ve been utilising digital signing for several years. One of our highest priorities is sharing electronic documentation for signature as securely as possible – which is why we have decided to...

Compliance

To enable a claim for motor vehicle expenses via the “log book” method, odometer readings need to be recorded as at 30 June. If you are self employed, or an employee in your own right, and the vehicle you drive has less than 1-tonne carrying capacity, please submit...

Compliance, Tax Tips

By Marie Olesen If your business isn’t up to date with your PAYG withholding obligations, you may not be entitled to claim any business related tax deductions. From 1 July 2019, businesses will no longer be entitled to claim a tax deduction for payments made where...

O'Connells OBM uses cookies to monitor the performance of this website and improve user experience. View our privacy policy to review how we use them and your data.

AcceptDeclinePrivacy policy